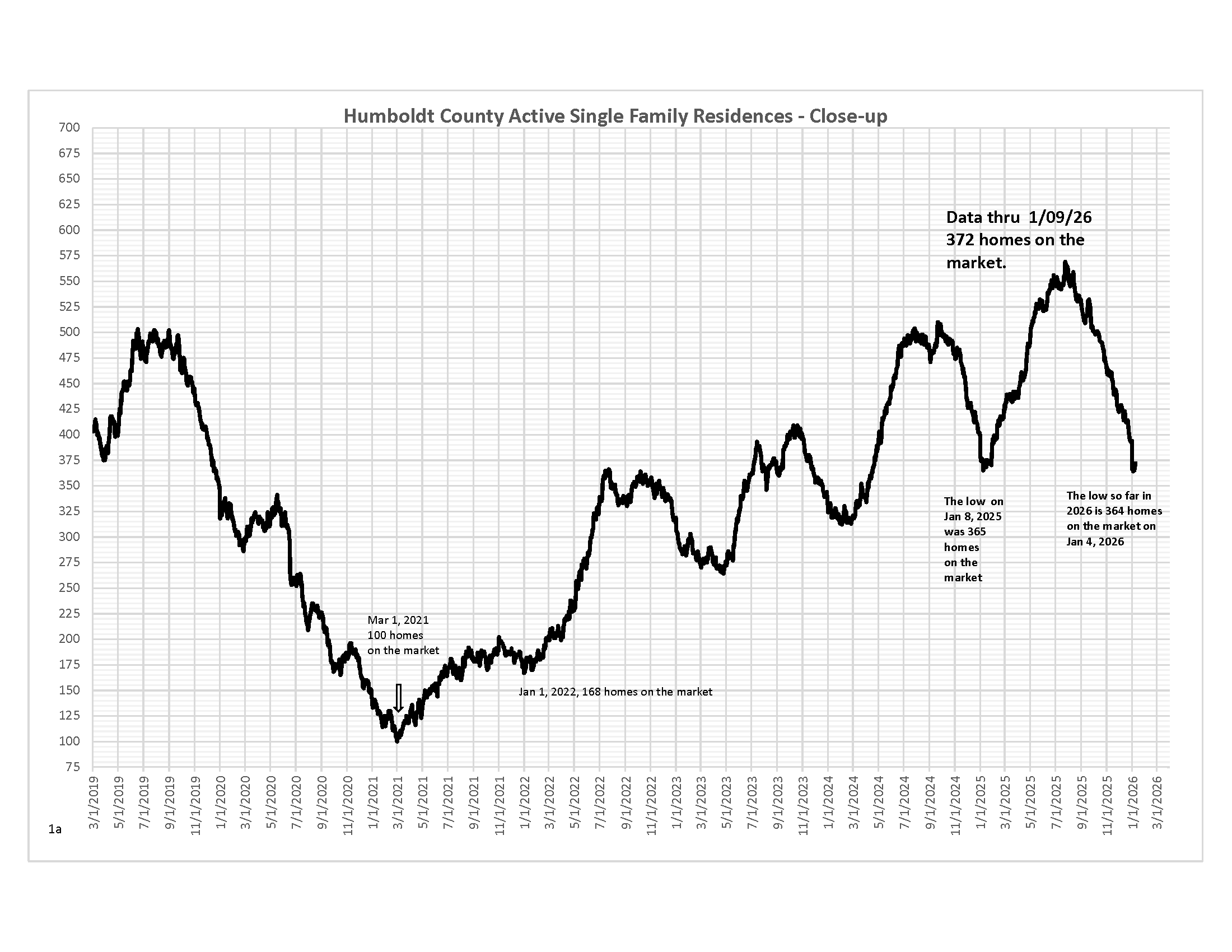

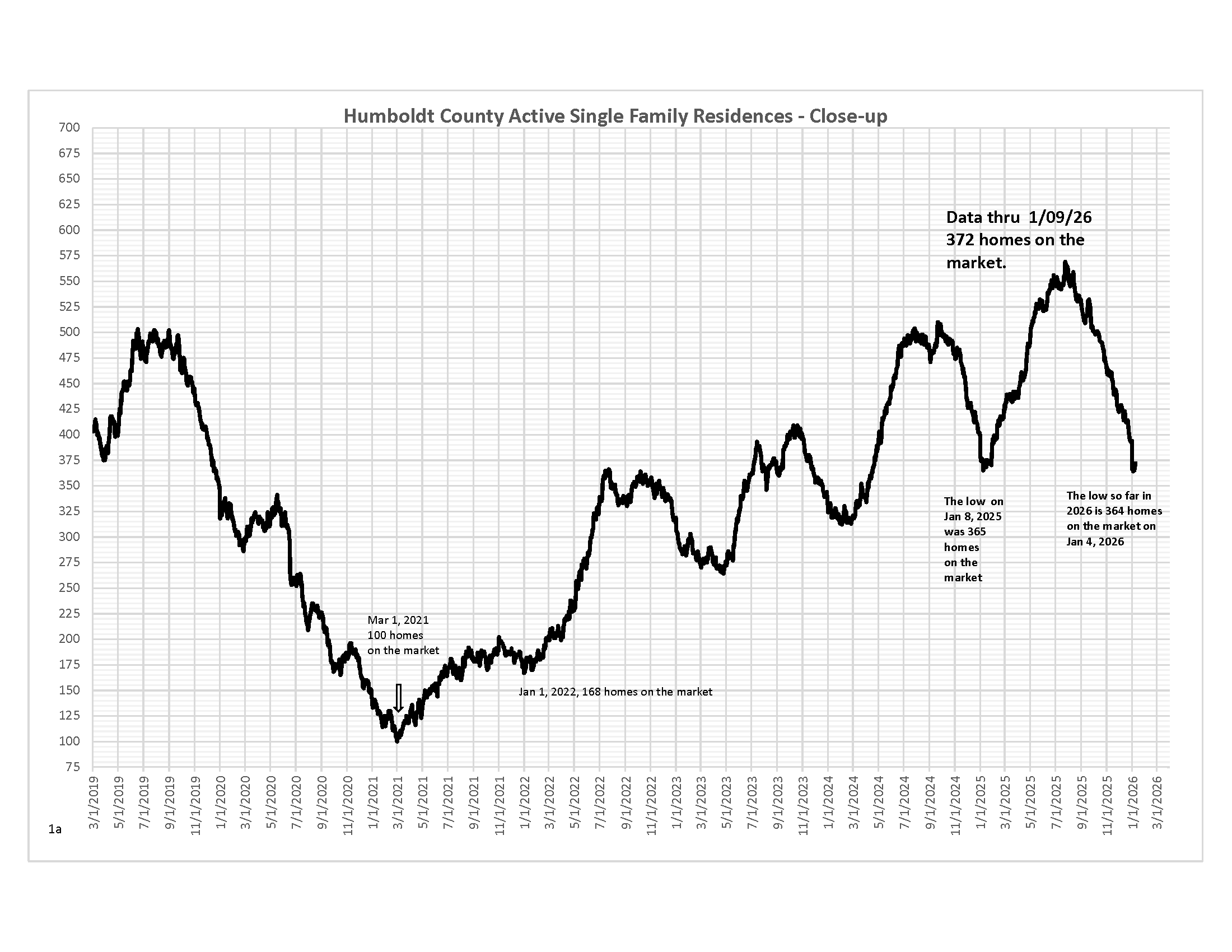

Active Residences (Current Inventory)

Active residences (current inventory) – Last month, I wrote, “We can expect modestly lower numbers into the end of the year,” Inventory decreased more than I anticipated in the last month. As homes expired or were sold, they were not replaced by new inventory. We are now near the same number of homes on the market as we were this time last year. Inventory was at 426 homes on Dec 7, 2025, and is now at 372 as of January 4th, 2026. We should begin to see more inventory come to market in the days ahead.

The monthly charts are updated through January 2026

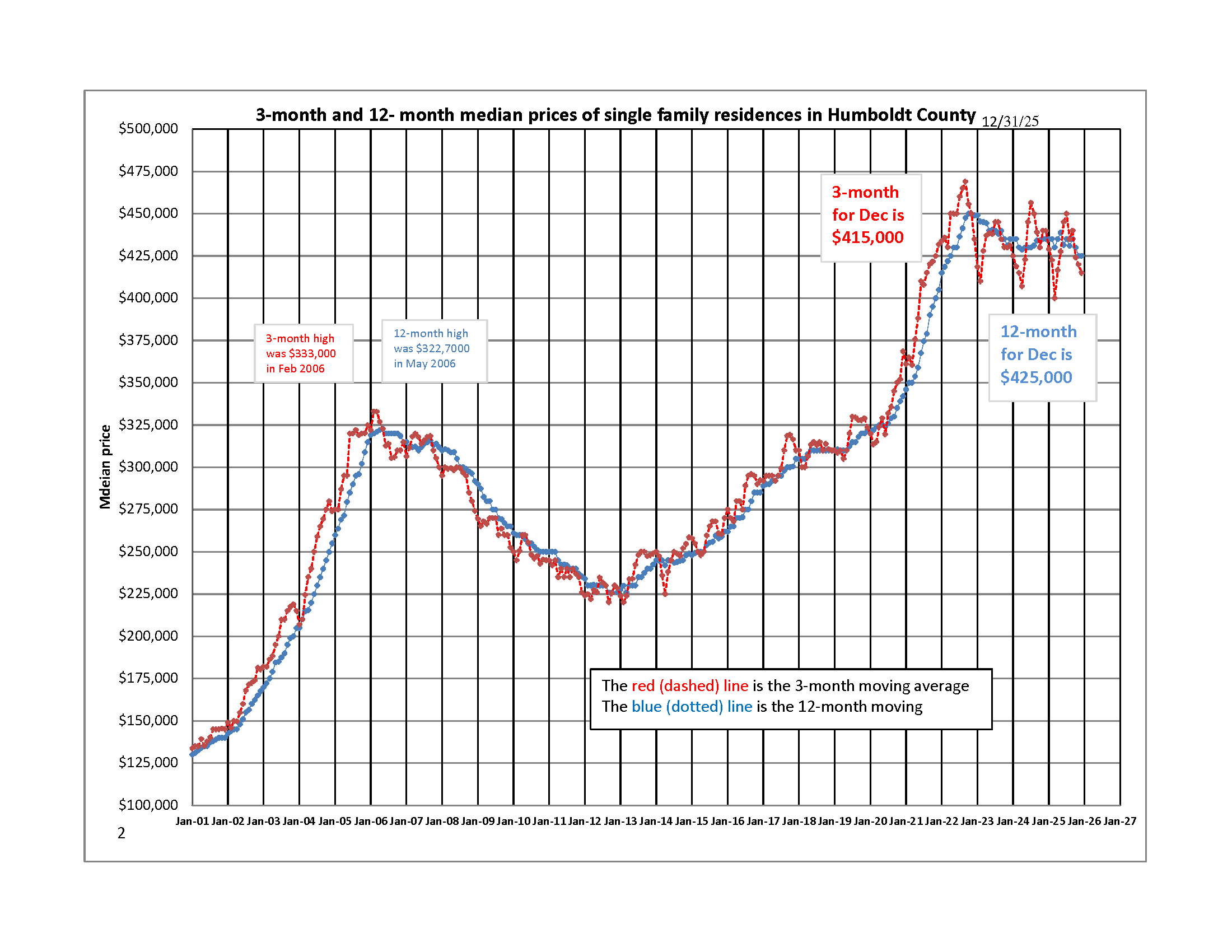

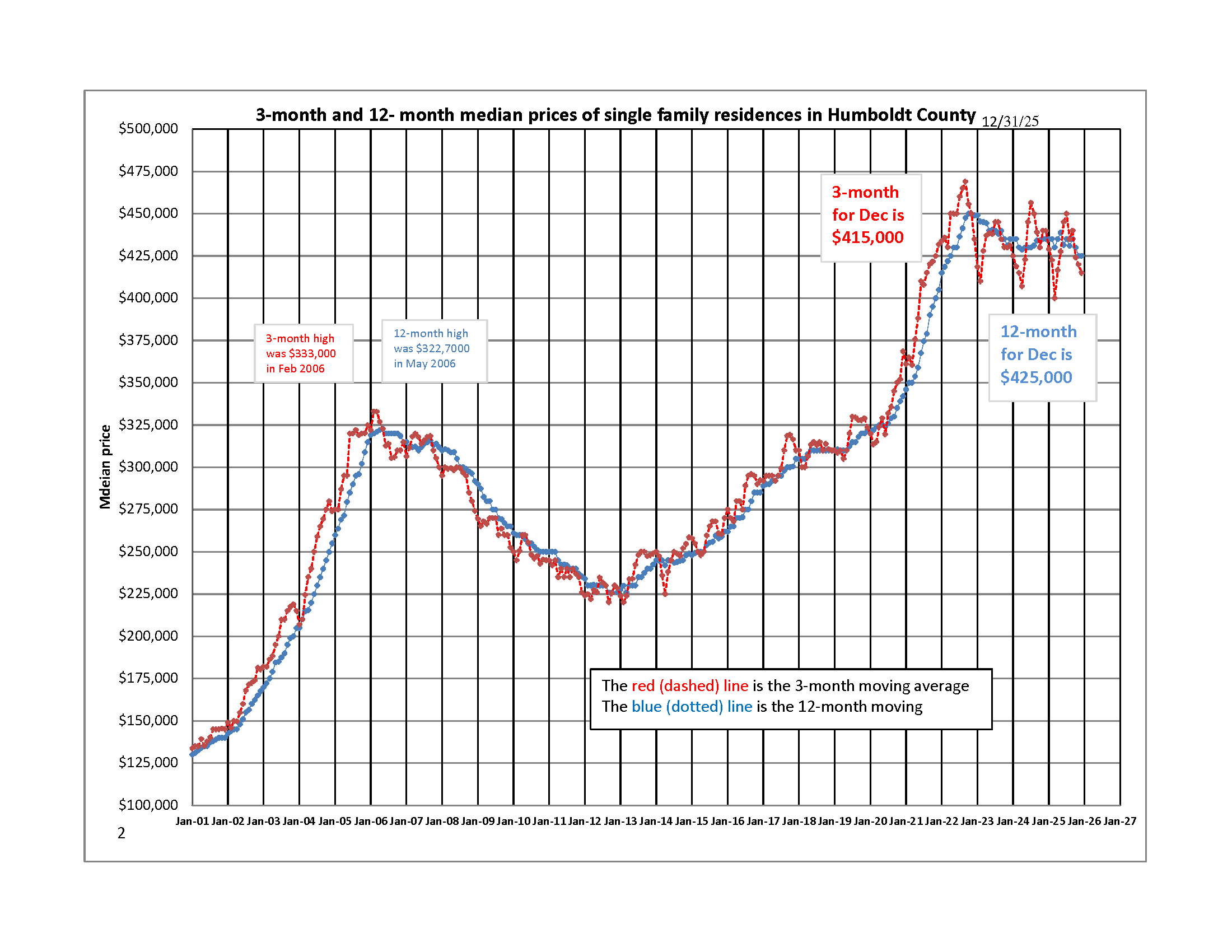

Median Prices

3 & 12-Month Median Prices. The 3-month median price decreased from $420,000 in November to $415,000 in December. Prices remain range-bound, as they have for the past few years. The 12-month median average price remained unchanged at $425,000.

The monthly charts are updated through January 2026

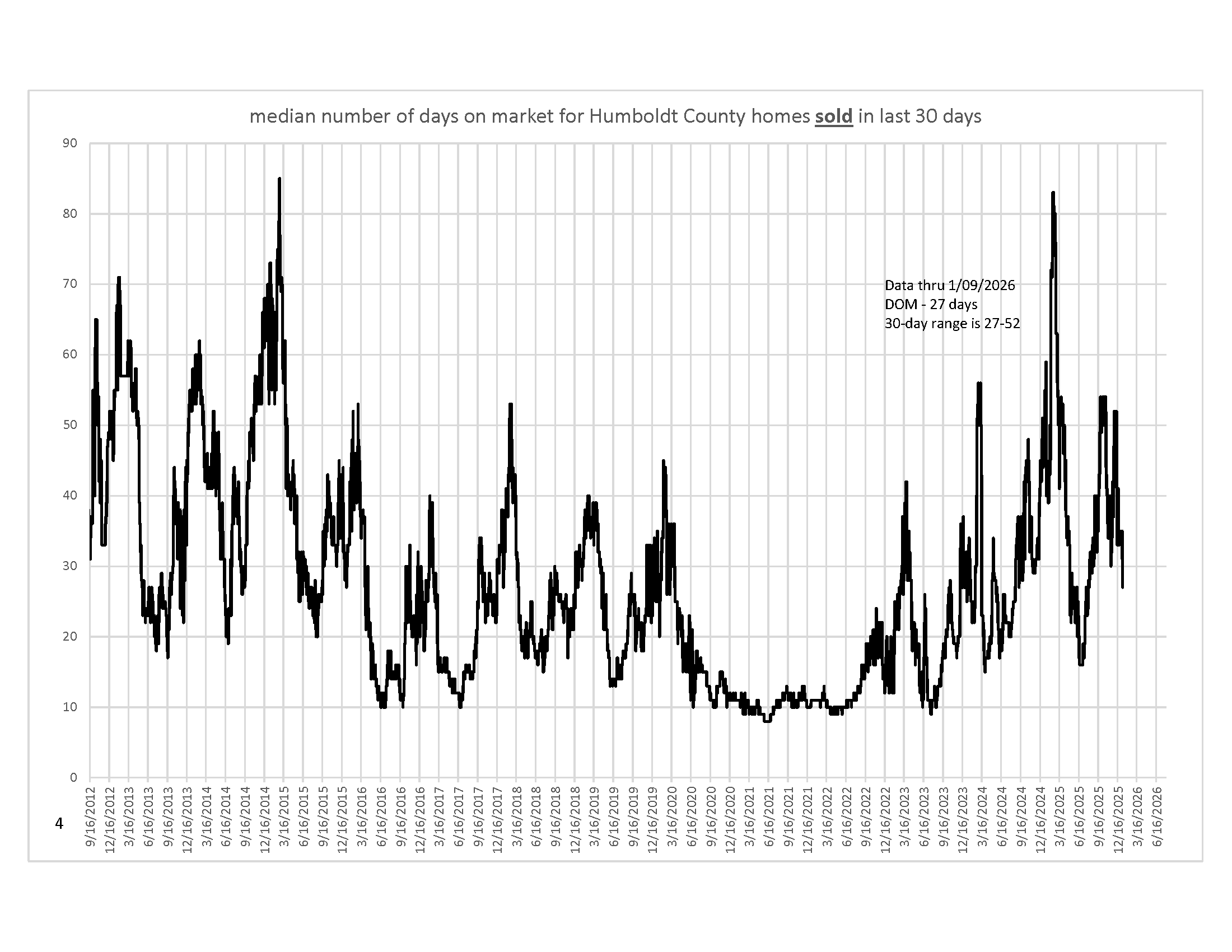

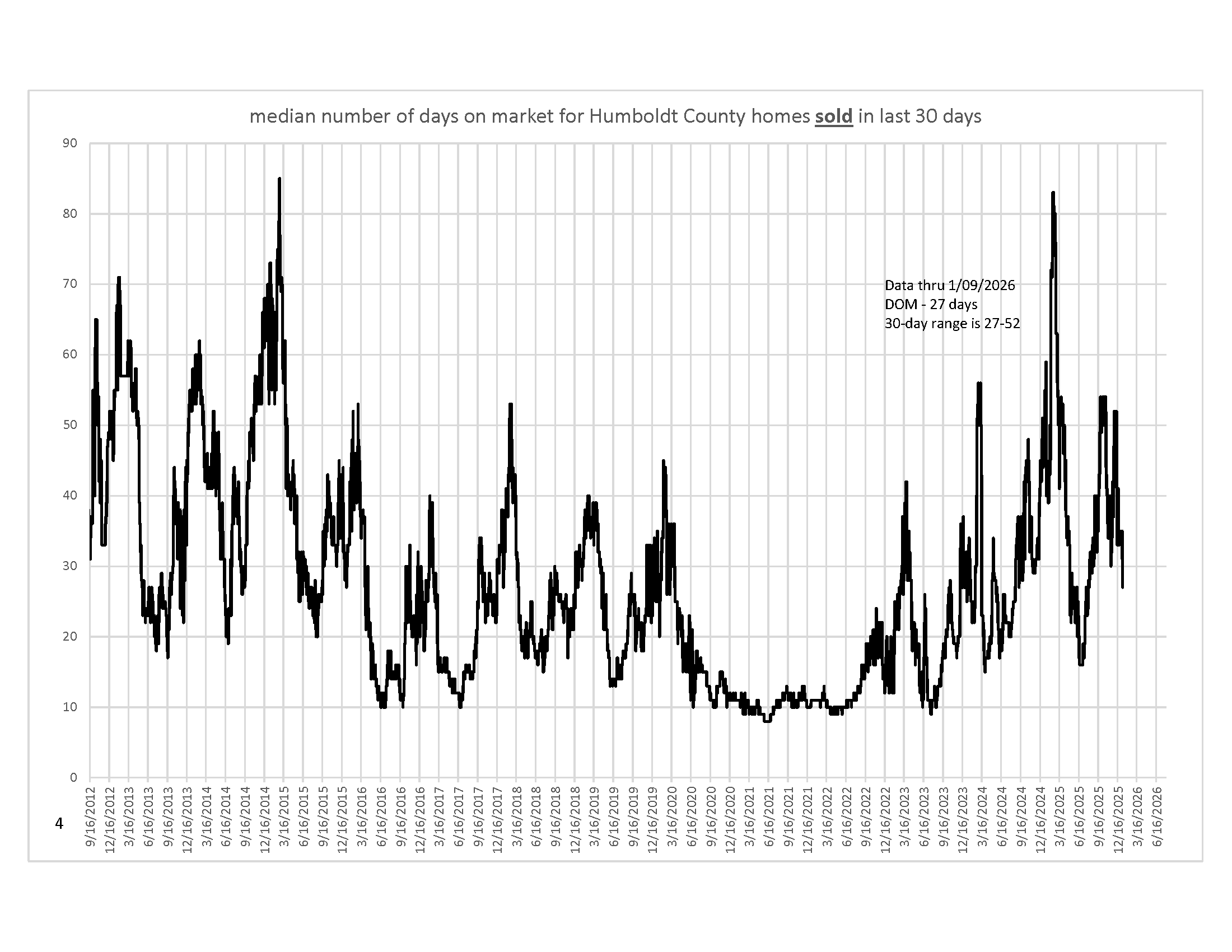

Median Days on Market For homes sold over the past 30 days

Median DOM (days on market - the time it takes for 50% of homes to leave the market for homes that sold over the past 30 days). Normally, in the fall and winter, median Days on Market remained modestly high and did not spike as they did last year. The range was 27-52 in December/January, and it was 27 on January 9, 2026. Recently, more favorable interest rates have allowed buyers to make offers more quickly and have them accepted. Let’s hope this trend continues.

The monthly charts are updated through January 2026

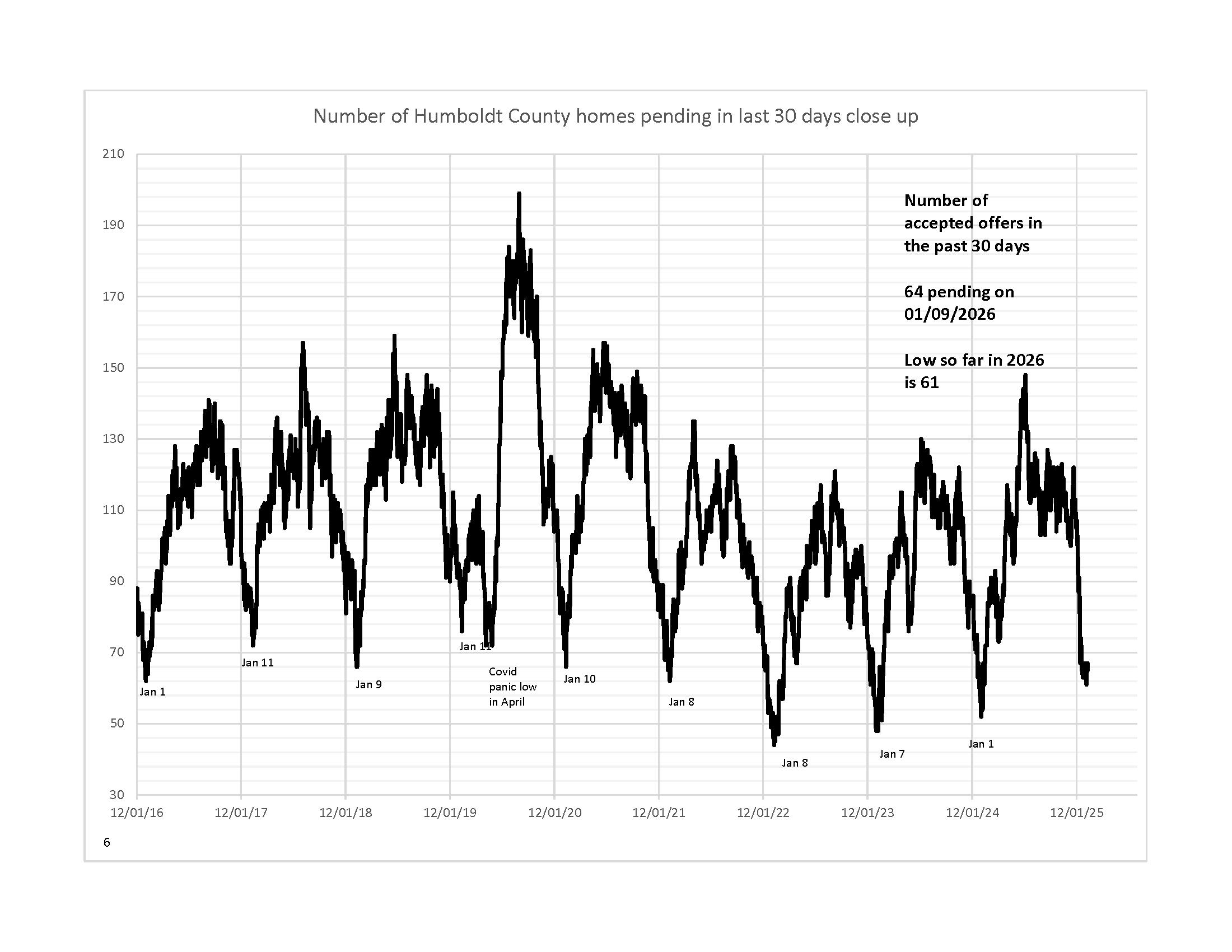

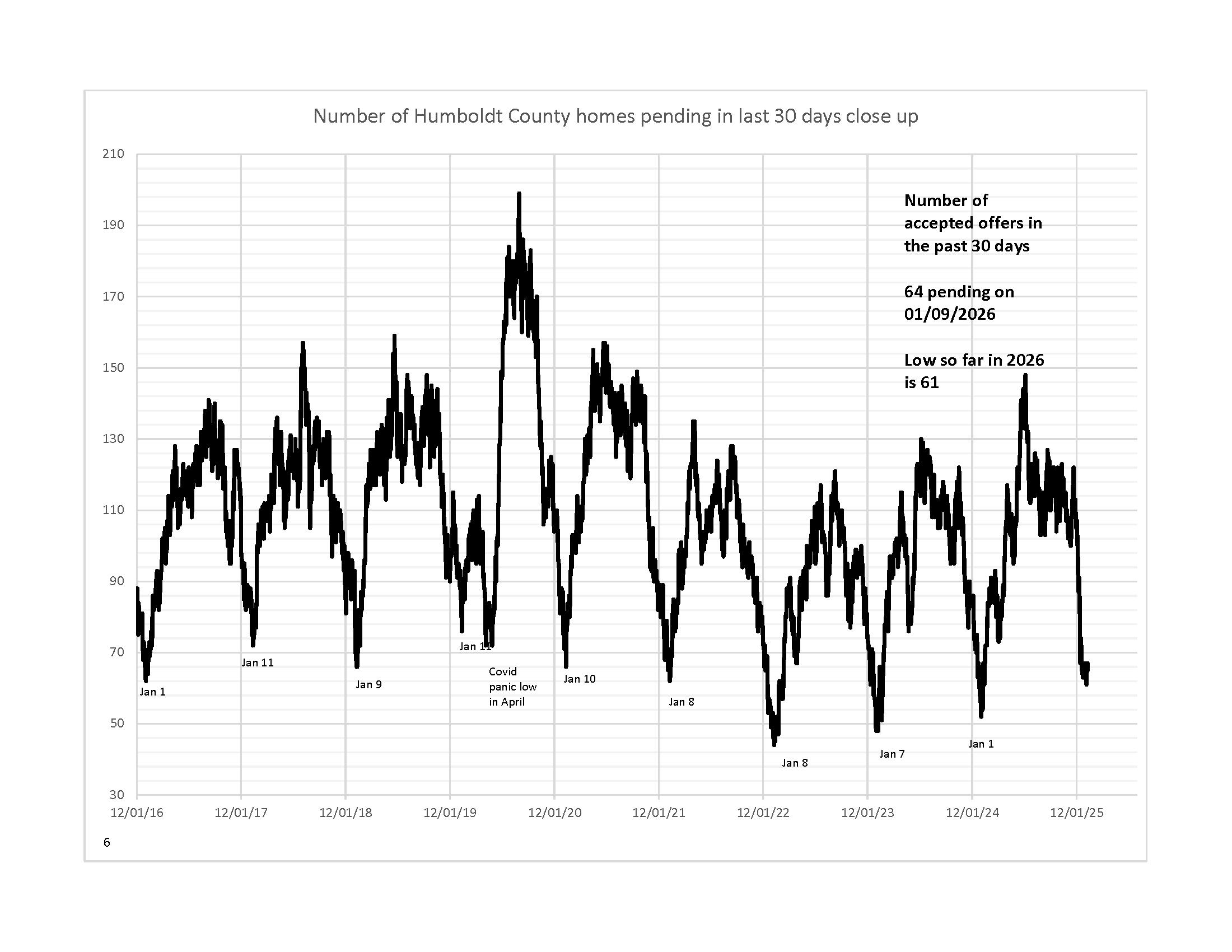

Number of Homes Pending in the Past 30 Days

Number of pendings over the last 30 days, close-up. Last month, I wrote, “I expect lower numbers into January,” and lower they went. Even though buyers acted more quickly than in previous months, they made fewer offers. The number of homes that went pending decreased from 91 in early December to 64 on January 9, 2026, with a low so far of 61 on January 4. The seasonal low in sales typically occurs in this period, and I expect sales to increase in the weeks ahead.

The monthly charts are updated through January 2026

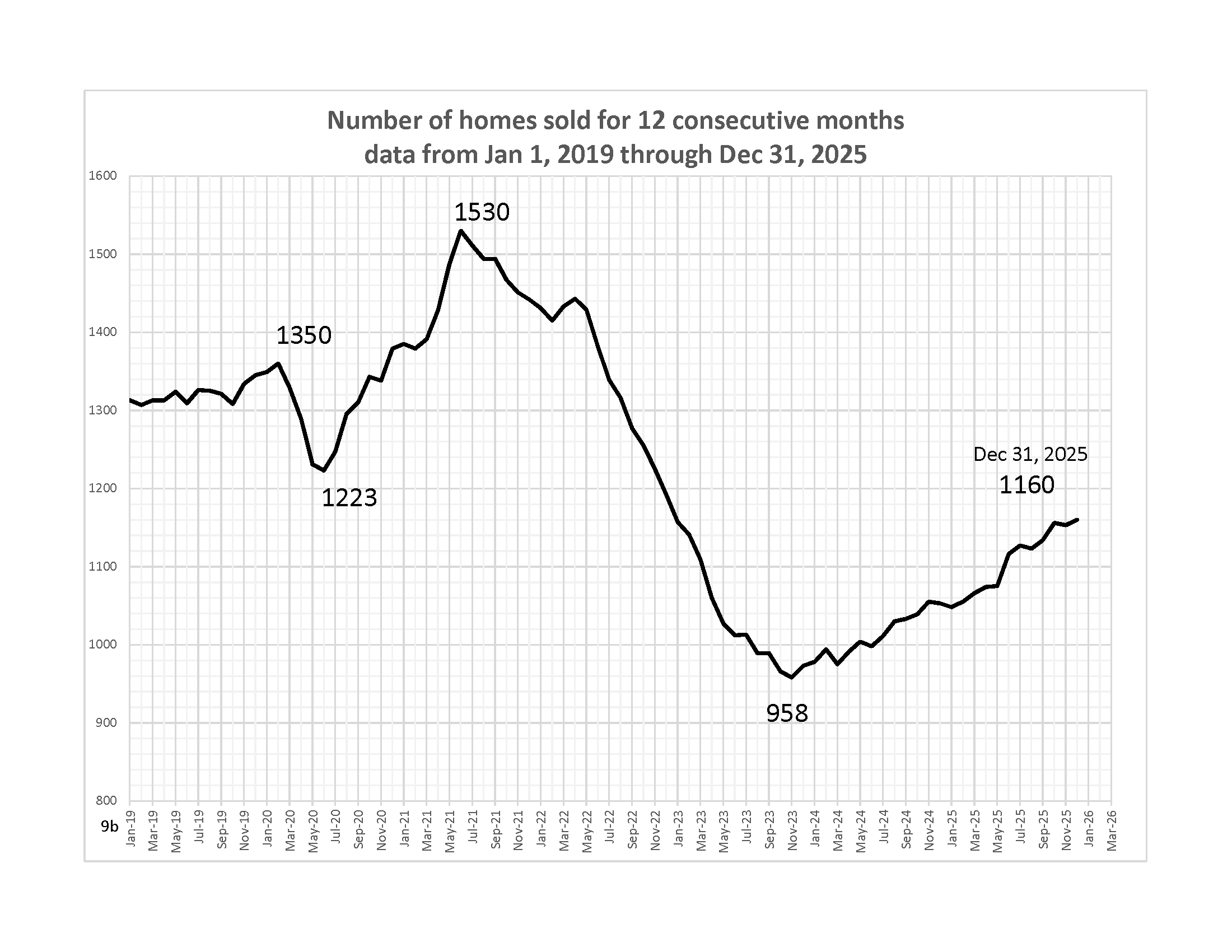

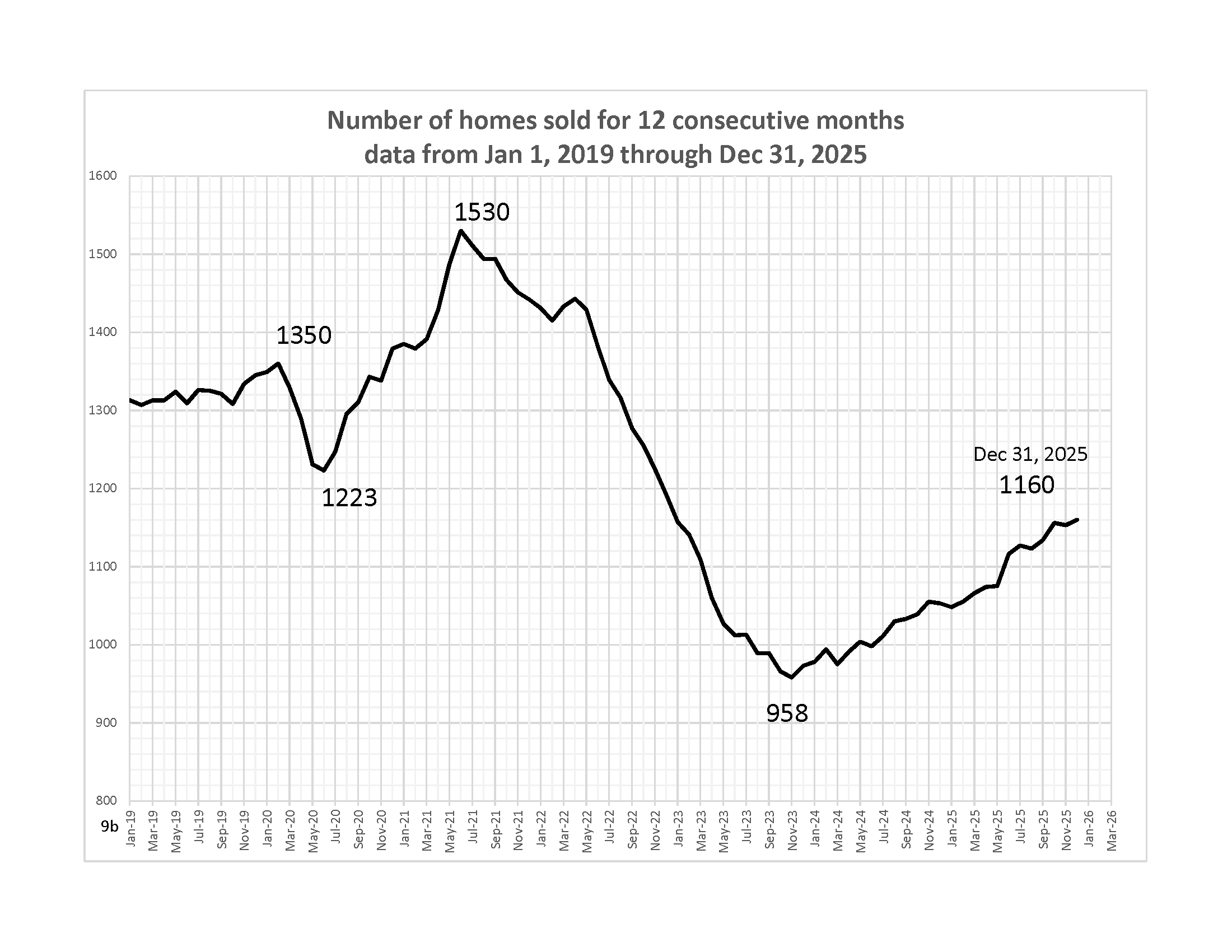

Homes Sold for 12 Consecutive Months

Homes sold for 12 Consecutive Months. The number of homes sold for the 12-month period ending in October was 1,156; it decreased to 1,153 in November and ended the year at 1,160. We have continued in this uptrend now for two years.

The monthly charts are updated through January 2026

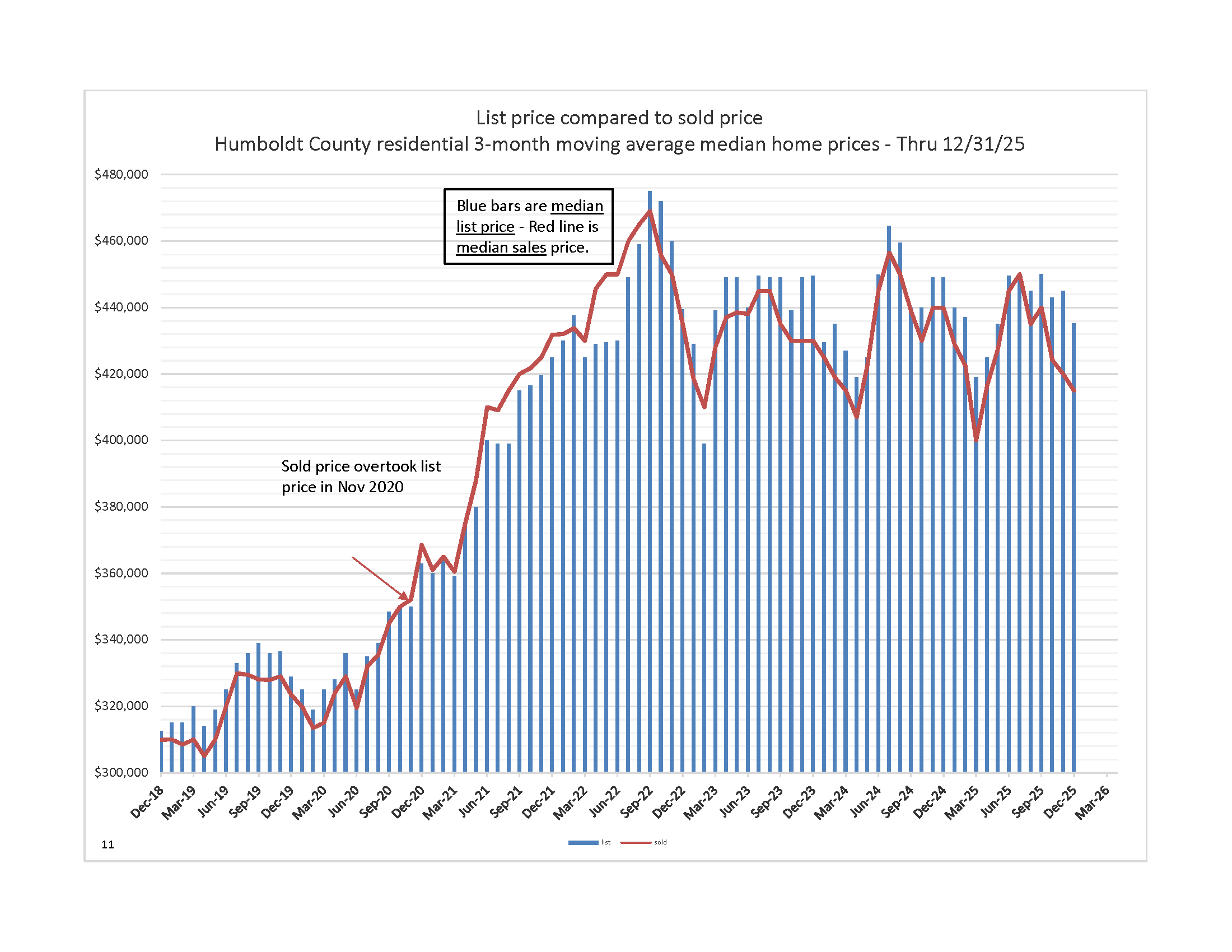

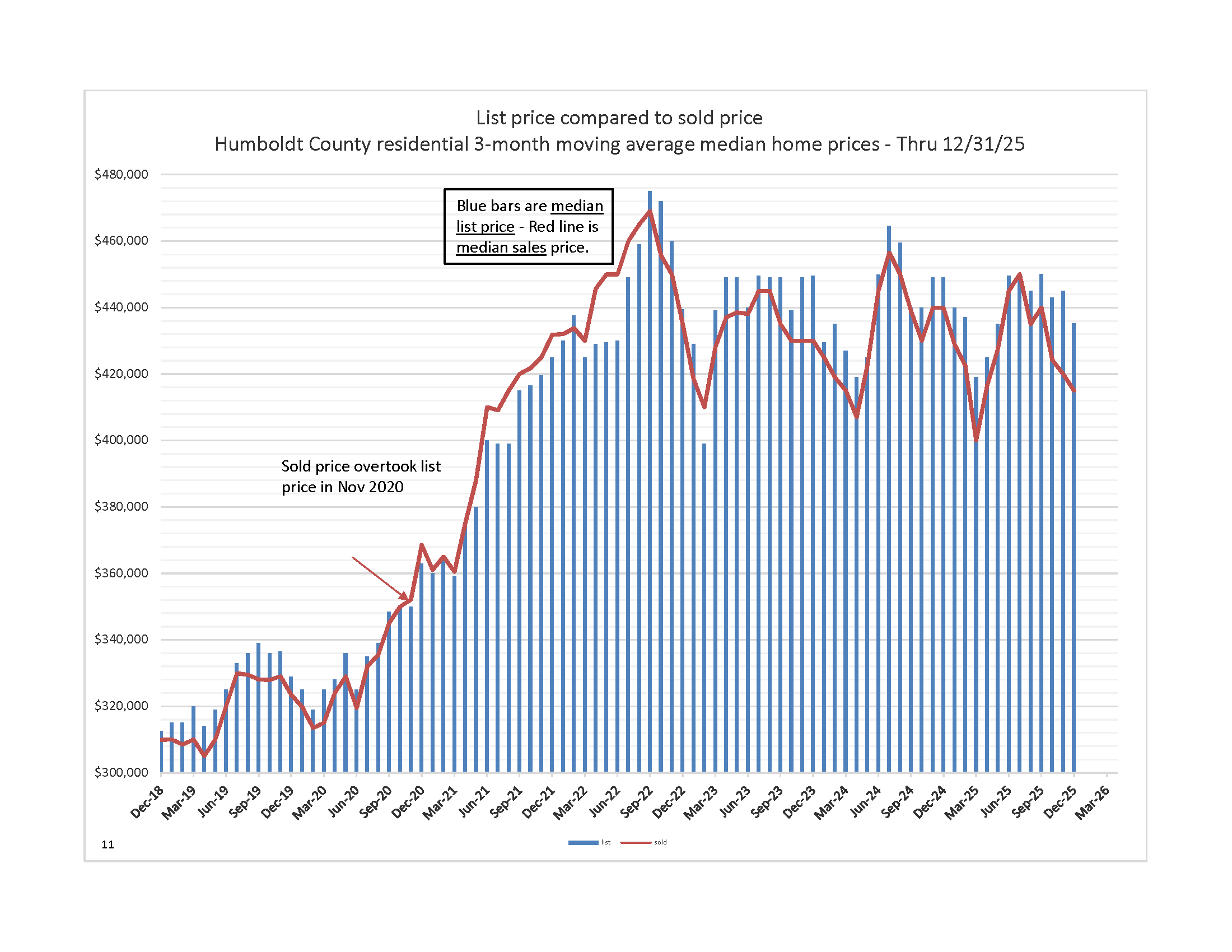

3-month median list price compared to 3-month median sold price

3-month median list price compared to 3-month median sold price. Last month, the median list price rose as sellers resisted downward pressure, while median sales prices fell as buyers gained the upper hand. This month, both median list and sales prices decreased. Median list price fell from $445,000 to $435,250, and median sales price fell from $420,000 to $415,000. We are still range-bound.

The monthly charts are updated through January 2026